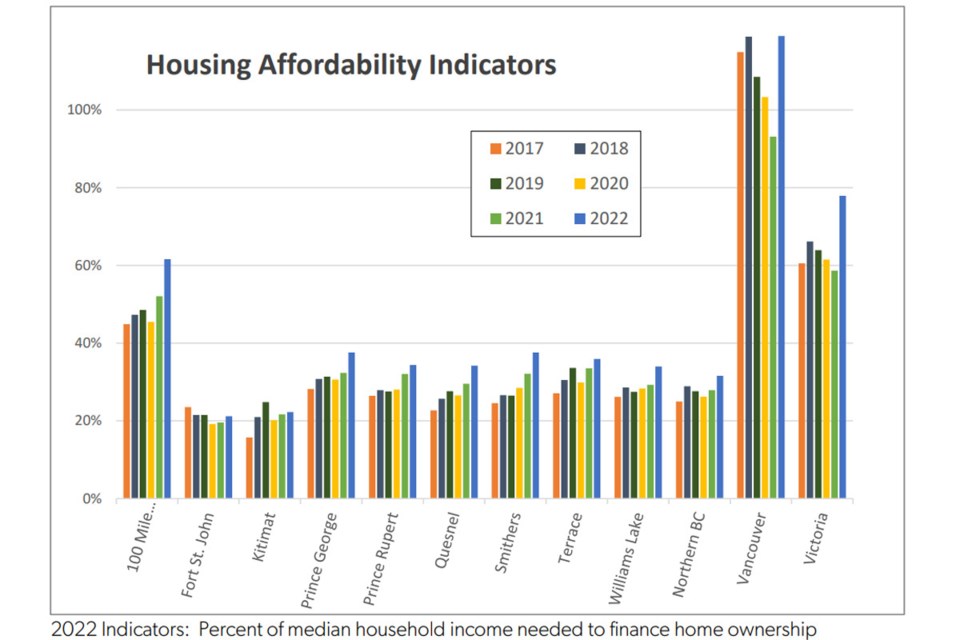

Northern and central 小蓝视频 saw an average 13.2 per cent increase in home ownership costs between 2021 and 2022, according to a report released by the 小蓝视频 Northern Real Estate Board.

The average Housing Affordability Indicator score – the percentage of a median household income needed to cover the major costs of home ownership of a house bought that year: mortgage payments, property taxes, fees and utilities – increased from 18.4 per cent in 2021 to 31.6 per cent in 2022, the real estate board reported. The area covered by the 小蓝视频 Northern Real Estate Board covers communities from 100 Mile House and north.

“Affordability worsened in 2022 for a second consecutive year in all measured northern 小蓝视频 communities,” the report says. “Prince George, 100 Mile House, Quesnel, Smithers, and Williams Lake all recorded significant deterioration, with affordability worsening by more than 10 (per cent).”

100 Mile House had the highest Housing Affordability Indicator score at 61.6 per cent, driven largely by the low median household income in the community.

Prince George and Smithers were tied as the second-least affordable measured communities in northern 小蓝视频 at 37.6 per cent, followed by Terrace (36 per cent), Prince Rupert (34.4 per cent), Quesnel (34.2 per cent), Williams Lake (34 per cent), Kitimat (22.3 per cent) and Fort St. John (21.2 per cent).

According to the Canada Mortgage and Housing Corporation, for housing to be considered affordable it must cost less than 30 per cent of a household’s before-tax income. The average cost of owning a single-family house in the 小蓝视频 Northern Real Estate Board area rose above that level for the first time in 2022.

“In all measured communities, except Kitimat, the average price for a detached single-family home in northern 小蓝视频 increased in 2022 over 2021. For Smithers, 100 Mile House, Williams Lake, and Prince George, the increase was significant,” the report says. “Prince George recorded the highest average sales price (in north-central 小蓝视频) at $524,221.”