The industrial real estate vacancy rate in Metro Vancouver, which is already in the sub-1 per cent level in four municipalities, will soon fall below 1 per cent across the entire region, which is unprecedented, according to a forecast from commercial real estate agent CBRE.

“We believe continued strong demand and a critical lack of supply in the current market will force the vacancy rate below 1 per cent for the first time [in 2021]” said the CBRE Industrial projection, released February 18.

The four markets where the industrial vacancy are under 1 per cent are Delta (0.4%), Surrey (0.6%), Maple Ridge/ Pitt Meadows (0.9%) and North Vancouver (0.8%).

“Surrey is the largest industrial market in the Lower Mainland and seen as a safety net for supply over the past decade,” CBRE noted, adding “But this is no longer the case as the Fraser Valley now has a lower overall vacancy rate than Vancouver, Burnaby and the Tri-Cities.”

Demand for industrial space appears driven by distribution space needed by large retailers and the e-commerce sector.

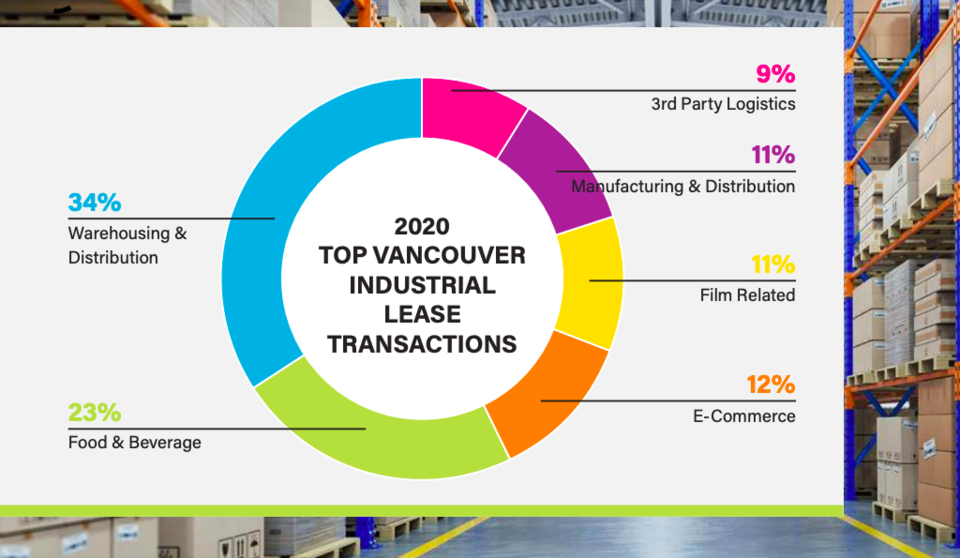

In 2020, warehouse and distribution accounted for 34 per cent of the 4.9 million square feet taken up in the industrial market, with food and beverage accounting for 23 per cent, up from a 6 per cent share in 2019. E-commerce claimed 12 per cent of absorption, which was ahead of both manufacturing and the film industry, which each accounted for 11 per cent of the industrial demand. Third-party logistics – which involves storage and shipment from multiple sources – captured a 9 per cent of the 2020 industrial take up in 2020.

Major companies completing built-to-suit industrial asset last year include grocery giant Sobeys, building a 530,500-square-foot distribution warehouse in Surrey.

This year, Walmart is expected to complete a 296,000 square foot “fulfillment centre” in Surrey and dairy firm Saputo Inc, will open a production and distribution centre of approximately 358,000 square feet in Port Coquitlam.

There continues to be an imbalance of demand and supply, with few significant speculative industrial projects underway, according to CBRE, which suggests vacancy rates will remain the third-lowest in North America in 2021 and 2022.

The shortage of space and high demand has driven Metro Vancouver industrial rates higher. CBRE is forecasting average industrial lease rates to hit a record high of $14.00 per square foot this year, up 6 per cent from 2020.